Agtech in Brazil

The Covid-19 pandemic rapidly accelerated technology development and adoption in Brazil’s agriculture sector, according to a new market map of the Brazilian agtech ecosystem.

The Radar Agtech Brasil map details 1,574 agtech companies in 33 categories and three field segments and its creators added a new company each day of the past 15 months; that’s 449 new companies in just over a year.

“Brazil currently has the most robust and decentralized movement of agtechs on the planet. The resiliency of the ecosystem was tested during the pandemic and passed with flying colors,” says Francisco Jardim, founding partner of SP Ventures, an Agtech investor based out of São Paulo, Brazil that collaborated on the map.

For him, Brazil not only has a huge agricultural market, but it is expanding its competitive advantage with technological differentials that can solve local problems.

“Brazil is globally competitive and a serious contender in the majority of major agricultural commodities. Besides a growth opportunity, agrifoodtech has proven itself a defensive asset class as well; since the market performs well, even when the region is doing poorly,” Jardim says.

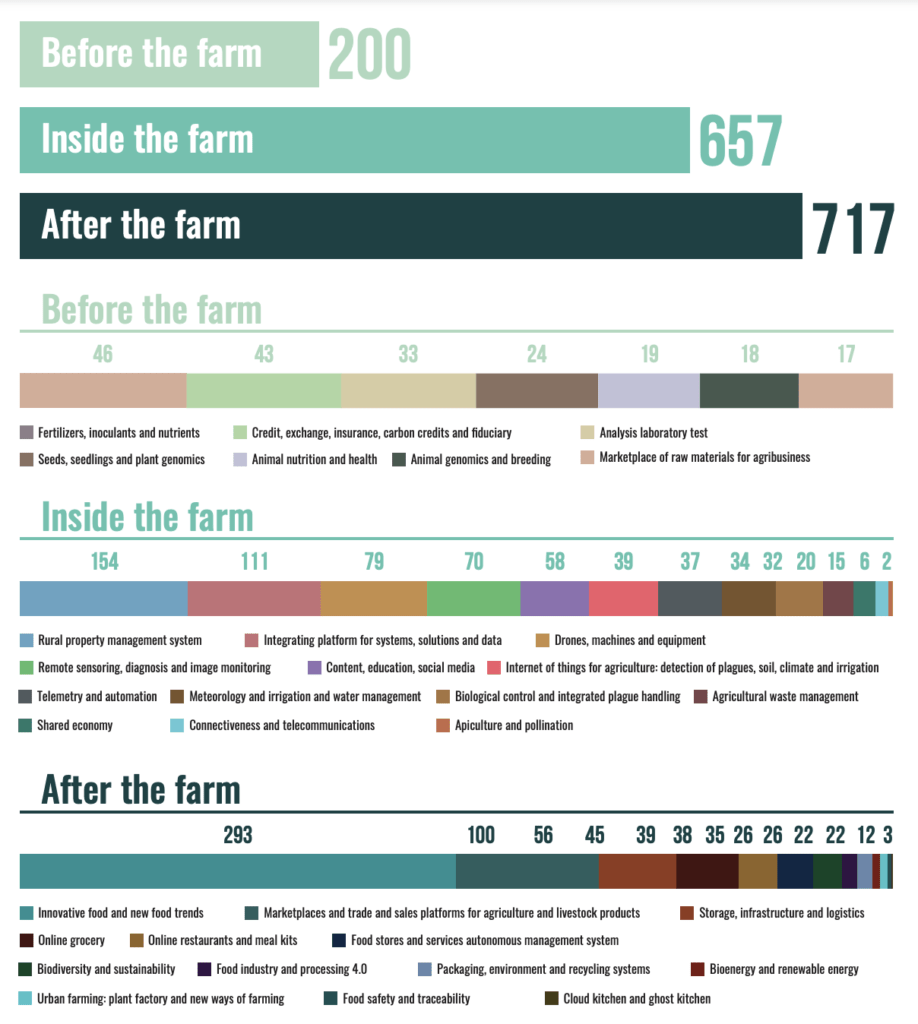

In its report, Radar Agtech Brasil mapped 1,574 agtech companies in 33 categories and three field segments, as follows:

Before the farm

includes areas such as fertilizers, credit, insurance, seeds, laboratory analysis, animal nutrition, genomics, animal reproduction

Inside the farm

includes property management, data, drones, remote sensing, IoT, meteorology, irrigation, pest management

After the farm

includes innovative foods, platforms for agricultural products, storage and logistics, biodiversity, sustainability, packaging

The study also provides a breakdown of Brazil’s agrifoodtech startups by focus area:

- Innovative foods and new food trends: 293 startups (18.6% of total startups)

- Rural property management: 154 (9.8%)

- Systems, solutions, and data integration: 111 (7.1%)

- Marketplaces and platforms for trading and selling agricultural products: 100 (6.4%)

- Drones, machines, and equipment: 79 (5.0%)

- Remote sensing, diagnostics, and image monitoring: 70 (4.4%)

- Content, education, and social media: 58 (3.7%)

- Storage, infrastructure, and logistics: 57 (3.6%)

- Fertilizers, inoculants, and plant nutrition: 46 (2.9%)

- Online grocery stores: 45 (2.9%)