Agtech in Australia

Looking to the future, Australian agricultural industry has the potential to become one of the most competitive, advanced, and efficient in the world. In 2019, the National Farmers’ Federation (NFF) set an ambitious target to grow the value of Australian agriculture from $60 billion to $100 billion by 2030. That’s a growth rate of 4.5% a year, which is almost triple the 1.7% growth rate the industry has averaged over the past decade.

However, two years into the roadmap and we’re off the mark, lagging in research, investment, and productivity gains. A recent Agribusiness Australia report found farmers were at least 6.3% below the growth rate required to hit the 2030 target. While this is partly due to lost exports from challenging climate conditions that have hampered production, and a deteriorating relationship with China, a large part is due to stagnant private investment in the sector.

With the vast majority of Australian farms being owned and operated by families, the main sources of capital funding the industry have traditionally been debt and retained earnings. While these investments will remain important in the future, they have a limited capacity and will not be enough to bolster farm gate production – according to Agribusiness Australia’s State of the Industry Report, the sector needs a capital injection of $250 billion to achieve the 2030 target. Estimates by Port Jackson Partners and ANZ found debt and retained earnings can service half of the capital required to meet the 2030 target, leaving a gap of $125 billion.

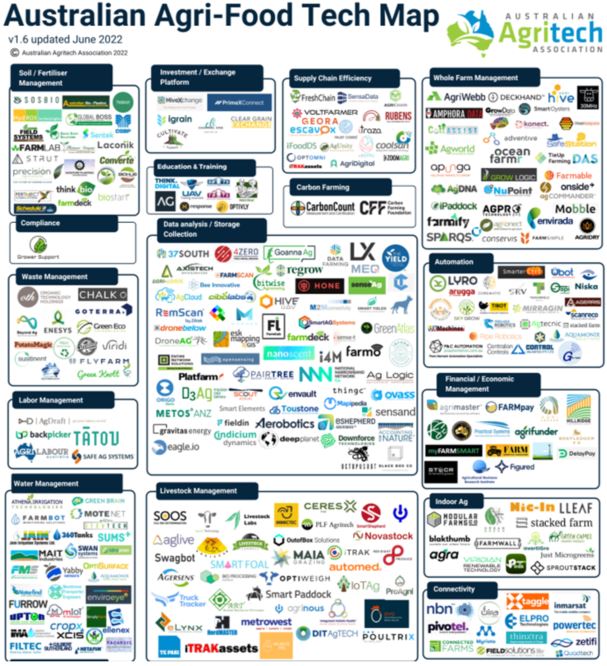

To bridge this gap, Australian agriculture needs to attract new investment from both domestic and foreign sources. Investment into Agtech – technology innovation, development, and adoption throughout the agriculture supply chain – will play a critical part in maximizing food production and solidifying Australia’s position as a major exporter of agricultural produce.